North Carolina Retirement Planning

Providence, Haywood, & Lamb Financial Group

Retirement is personal. You've worked hard to save and invest your money and now it's time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

Providence, Haywood, & Lamb Financial Group is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

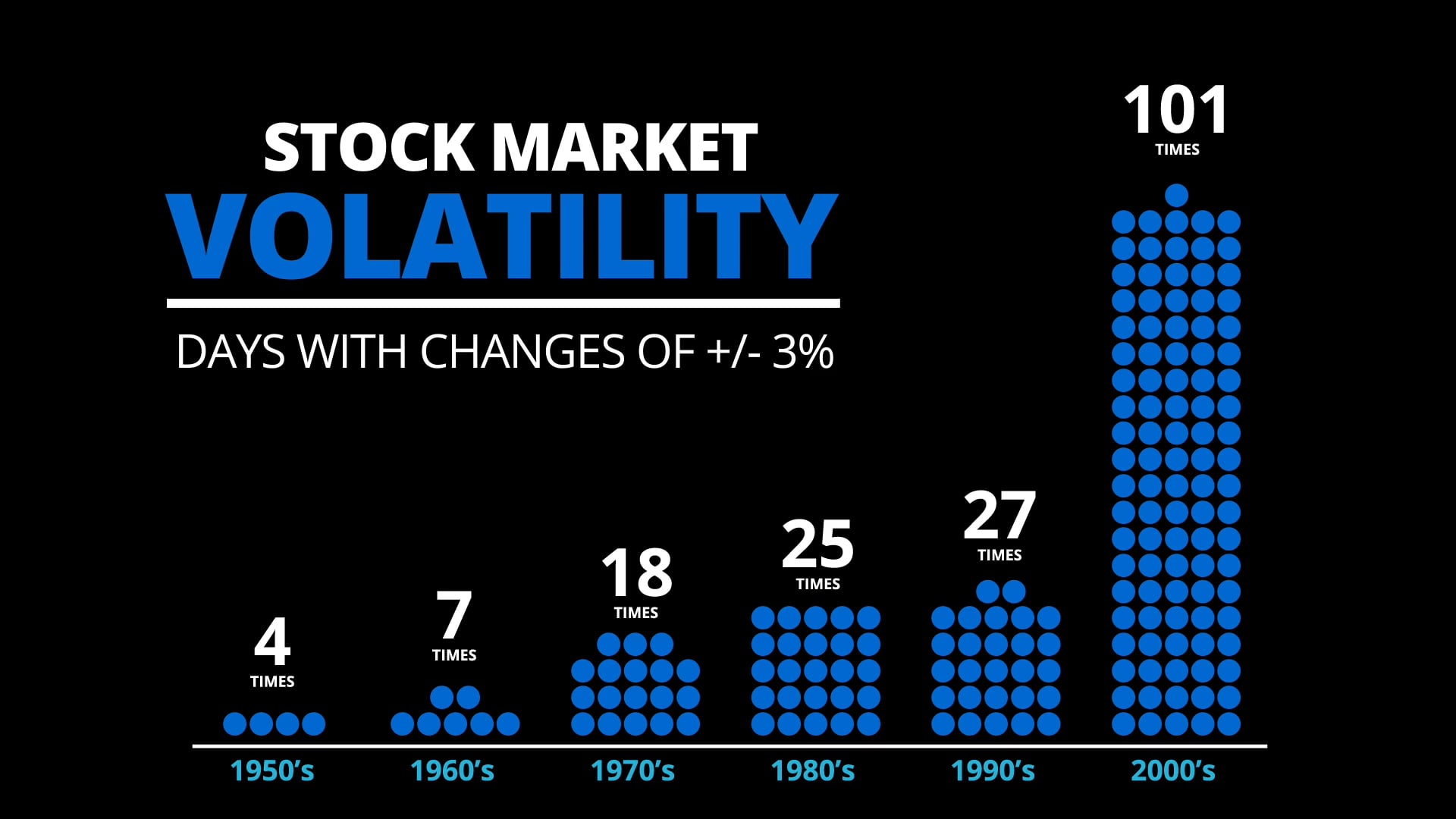

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Christopher Haywood

Rev. Christopher L. Haywood is a native of Raleigh, North Carolina and has roots in Fuquay-Varina where he attended high school. Currently, Rev. Haywood serves as the Senior Pastor of Big Bethel African Methodist Episcopal Church, located in Spring Hope, North Carolina, where "A stranger can find a friend and a sinner can find Christ." He has served as the Senior Pastor of Historic Allen Chapel African Methodist Episcopal Church in Jackson, North Carolina for ten years. Rev. Haywood also served as Senior Pastor of Praise & Deliverance A.M.E. Church (Wilmington, N.C.) for seven years. He has taught Theology, New Testament studies, Old Testament studies, Understanding the Bible, Homiletics, and Sermon Preparation throughout the U.S. at conferences, such as: African Methodist Episcopal, Baptist Church, Church of God in Christ, the African Methodist Episcopal Zion Church, Non-Denomination Churches, as well as many other secular and non-secular organizations.

Rev. Haywood was called to preach in 2000. He was ordained as a deacon in the AME Church in 2003 under the leadership of Bishop Vinton Anderson. In 2011, Rev. Haywood was ordained an elder under the leadership of Bishop Adam J. Richardson, Jr. Through God's grace and anointing, Rev. Haywood has led several different ministries, inclusive of: family planning, sons of thunder, food programs, mentorship programs, empowerment programs, financial planning, leadership, etc.

Rev. Haywood has spent the past 24 years in ministry, specializing in community leadership and development. He has served as a lead facilitator and consultant for Wilmington Housing Authority, in which he developed Operation S.T.E.P. (Start Taking Encounters Personally) to inspire youth across the Carolinas. He created and taught the implementation plans through motivational sessions and seminars. Rev. Haywood counseled staff and students in positive goal setting objectives, goal attainment, and the importance of developing life strategies for success. He also served as a global supply chain manager overseeing operations in the United States, Argentina, and facilitated trades in Asia. He served as a leader in customer service, production planning, and logistics at DuPont for twelve years. Pastor Haywood is a prolific motivational speaker, life coach, and is currently writing a book titled, "Investing in You", which is projected to be released in February 2026.

Rev. Haywood is a professional actor and has performed in Wilmington, North Carolina at Historic Thalian Hall, in Sam Art Williams, 'The Dance on Widow's Row'. Sam Art Williams was a member of the Negro Ensemble Company (Samuel Jackson, Denzel Washington, Adolph Ceasar) and an executive producer of the Fresh Prince of Bel-Air. Rev. Haywood has completed several voice-over projects, commercials, and motion pictures. Rev. Haywood plays the role of a Pastor in the short film called 'I Do', a bass drummer in the Frank Duson Jazz band in Bolden-the Silent Film, and is the voice for the Palm Cove Community Commercial, located at Sunset Beach, N.C. Be sure to follow him on social media and remember him in your prayers as he prepares for projects in the 4th Quarter 2025.

Currently, Pastor Haywood is pursuing his doctoral degree (Ed.D) in Organizational Leadership and Higher Education at Grand Canyon University, located in Phoenix, Arizona. He completed residency work in Clinical Pastoral Education at Duke University (Durham, N.C.). He has completed his residences, course work, and is working towards completing his dissertation in October 2025. He completed his Master of Divinity degree at historic Payne Theological Seminary, located in Wilberforce, Ohio, in May 2011. He shared a thesis on holistic and divine healing, supporting that God is a healer in the midst of the church service. He earned his Bachelor of Science degree in Apparel Textiles and Industrial Technology from East Carolina University, located in Greenville, N.C., in 1996. From 1991 through 1993, he was a linebacker and member of the ECU Pirates. In 1991 the Pirates were Peach Bowl Champions. They completed the year with an 11-1 record and finished the season by being ranked # 9 in the nation.

Pastor Haywood resides in Rocky Mount, North Carolina and is the proud father of four beautiful children: Diamond Lynette', Ebony Marie, Jaden Simone, and Christopher James. With all of his accolades he would want you know that he is a humble servant of God. All he is and all that he desires to be is because of God's Grace and Mercy. He is a child of God, a born-again believer. Remember, "When the Praises Go Up; The Blessings Come Down." God is so Awesome, that He doesn't need to consult your past, to determine your future." Blessing & Favor in the Lord Jesus Christ!!!

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in March–May 2026

March 12, 2026 (1 event)

March 12, 2026Course Name: Maximizing Social Security

Instructor: Christopher Haywood

Phone Number: (855) 477-8426

Location:

Bethel AME Church, 7340

Pleasant Grove Church Rd

Spring Hope, NC 27882Cost: Free

Registration Coming Soon

March 16, 2026 (1 event)

March 16, 2026Course Name: Maximizing Social Security

Instructor: Christopher Haywood

Phone Number: (855) 477-8426

Location:

Bethel AME Church, 7340

Pleasant Grove Church Rd

Spring Hope, NC 27882Cost: Free

Registration Coming Soon

Our Downloads

Legacy and Estate Planning; Understanding the Basics

Estate planning is an important part of retirement planning. You've worked hard for your money and want to see your children and grandchildren benefit, and you probably want to see it passed down in the most efficient way possible. Unfortunately, costly mistakes are all too easy to make, from forgetting to name a beneficiary on your retirement account to not updating your estate plan over time. It's not just billionaires who need to have solid estate plans; it's anyone who wants their wishes to be honored after their passing.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.